Blue Ocean Investment Partners

Investing in the Winners of Tomorrow

We generate long-term wealth for high-net-worth clients.

Investors get personalised service from our founder, who has 30 years of success as a professional investor.

For High-Net-Worth Individuals, Families, Endowments, and Funds

Who We Serve

High-Net-Worth Individuals, Families, Endowments, and Funds

We focus on experienced and sophisticated investors seeking to maximize their wealth and achieve their long-term financial goals. We accept clients from virtually every country in the world.

Long-term Perspective

Our clients understand the importance of a patient and disciplined investment approach, focused on long-term growth and value creation. Our returns can be volatile, but our clients understand that true risk is not achieving long-term return goals.

Why Our Clients Choose Us?

Focused Exposure, Differentiated Returns

Focused exposure to the winners of tomorrow aims to maximise return on investment with returns that occur at different times to the market, providing returns and diversification to investors.

Alignment with Success

Ted believes in the strategy and invests almost all of his liquid net wealth alongside clients. His confidence comes from his track record of success over three decades.

Safety and Security

Investor capital is safe and secure as all funds are held with a reputable third-party custodian in the client’s name. Blue Ocean has authority to trade your account, not make withdrawals, other than fees.

Our Approach and Results Differentiate Us

Different Approach

Traditional funds own 50-200 companies. We own 5-15 winners of tomorrow who are lesser-known today. As a result, our holdings and performance are very different to traditional funds and indexes.

Market Beating Performance

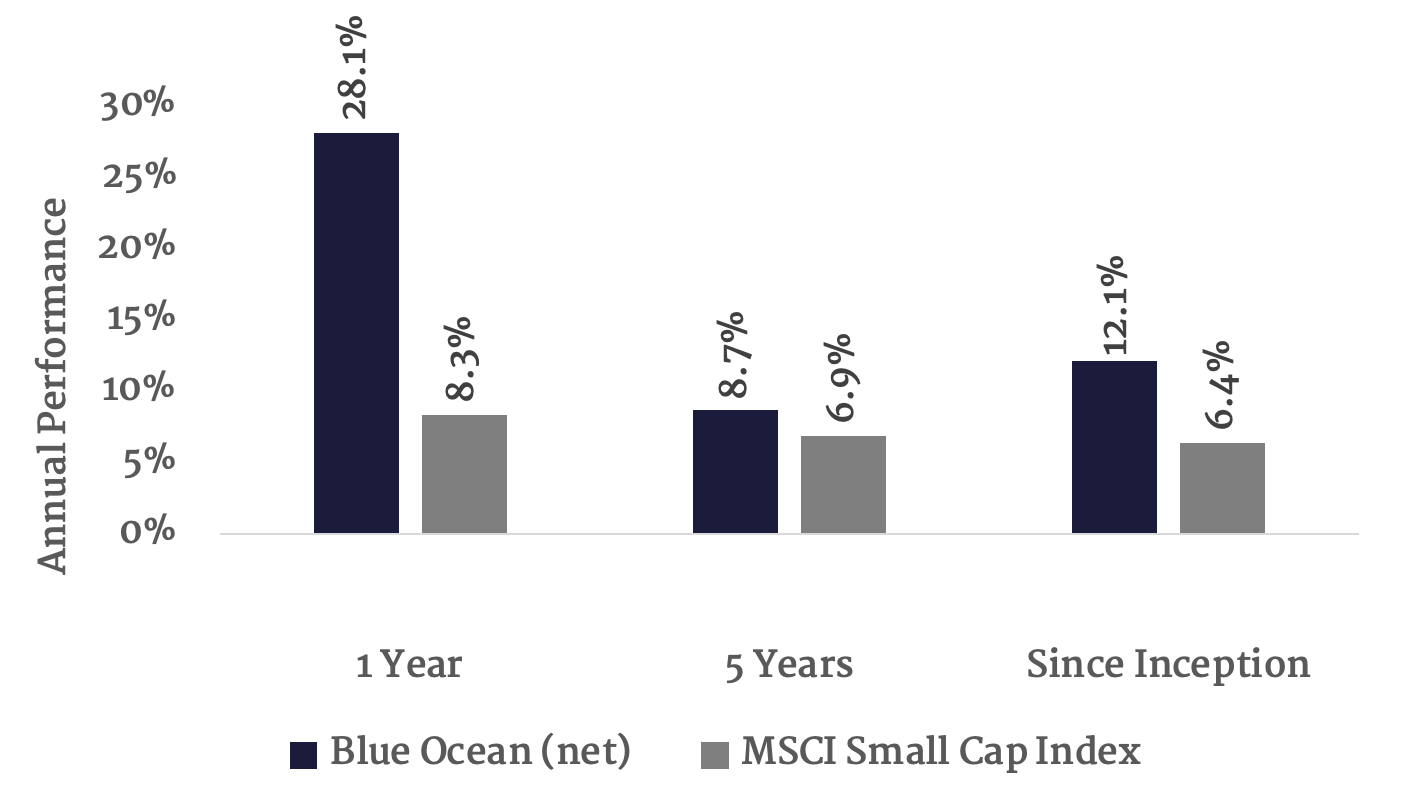

Unlike most options available to investors, Blue Ocean has outperformed the market, returning 115% performance (net of fees) since inception. The closest benchmark is up 51% over the same period.

Past performance is no guarantee of future returns. The value of investments and the income from them may fall as well as rise and is not guaranteed. The investor may not get back the original amount invested. Investments in this portfolio are denominated in U.S. dollars. Changes in exchange rates between the U.S. dollar and your base currency (e.g., GBP) may significantly impact the value of your investment and any returns when converted back to your local currency. The inception date of the strategy is May 7, 2018. Performance is presented net of a 1% management fee and a 30% fee for performance above the benchmark index. Data through December 31, 2024. Please refer to disclaimer for important notices.

What is a Winner of Tomorrow?

A Winner of Tomorrow meets these criteria:

Proven Aligned Management

Sustainable Competitive Advantage

Large Addressable Market

Minimal Long-term Risks

Priced for a Margin of Safety

While we believe the long-term risks are minimal, individual investments and the portfolio can be volatile and lose significant value in the short term.

Safety and Security of Your Investment is a Primary Concern

Custodian Held

Client funds are held securely in the client’s name with a reputable custodian, safeguarding your assets.

Risk Mitigation

Our rigorous risk management framework avoids leverage and derivative exposure, preserving your capital.

Transparency

Investors receive regular, detailed reports of portfolio holdings and performance. Ted interacts directly with clients as needed.

What Our Clients Say

These testimonials were provided by current clients. No compensation was provided for these reviews. There are no material conflicts of interest between the reviewers and our firm.

-

I have been an investor in Blue Ocean since the inception of the fund. I have had a long-term relationship with Ted Holmes and have confidence and trust in him as a result of his strong, long term, investment background from his years with UBS. His strategy is a good compliment to my other financial advisors who do not focus on the smaller cap yielding stocks that could be the winners of the future. This is a differentiator from my other holdings and overall market exposure and the high conviction level of the Blue Ocean portfolio is striving for a higher return of capital. As noted with Ted’s 30 years of successful investing experience I am comfortable giving the firm and the investment strategy a strong endorsement as an investment vehicle.

-

I have known Ted professionally for 17 years, and he has always been open and refreshingly honest, not just on a personal level but also in his views on value investing. This and his focus on detail have given me great confidence in Ted’s ability to manage my portfolio.

Alignment for Shared Success

Ted Holmes, CFA, CPA

Founder and Chief Investment Officer

Ted brings nearly 30 years of investment expertise and a proven track record of delivering results to Blue Ocean Investment Partners. With an MBA from the University of Chicago and as a CFA and CPA, Ted combines uses his financial acumen to identify undervalued opportunities delivering long-term growth for investors. His disciplined approach has been honed through decades of experience navigating major market cycles including the dot-com bubble, global financial crisis, and COVID-19.

Ted’s career highlights include his tenure at Brinson Partners, where he emerged as one of the firm’s top analysts globally. His innovative approach transformed the tech sector into a key driver of client returns and formed the foundation for Blue Ocean’s investment philosophy. Later, as European Head of Equities at UBS Asset Management, Ted oversaw $20 billion in client assets while maintaining a focus on bottom-up stock selection and a disciplined research process.

In 2018, Ted founded Blue Ocean to maximise the return on his own capital and to focus his time doing what he loves, finding hidden gems in the markets. He opened the Blue Ocean strategy to clients so they too could benefit from his hidden gems. Ted also serves on the boards of the City of London Investment Trust and the River UK Micro Cap Company.